Table of Content

SBI doesnt take any responsibility for the images, pictures, plan, layout, size, cost, materials shown in the site. We have a network of + branches, sales teams and processing centers across the country to cater to the housing loan requirements of individual customers. Please locate us and contact us for your home loan requirements.

The bank has also raised the base rate by similar basis points to 8.7 per cent. According to the latest update on the SBI website, these changes will take effect from 15 December 2022. SBI home loans have a consolidated processing fee which is 0.40% of the loan amount plus the applicable GST. The minimum amount is Rs.10,000 plus GST while the maximum amount is Rs.30,000 plus GST. Pradhan Mantri Awas Yojana can help you save money on your first house. Under the scheme, you can get subsidy of up to Rs.2.67 lakh.

How much Interest Will I Have to Pay for a Home Loan of Rs. 50 lacs?

The result will also show the total interest component of the home loan. The borrower can make adjustments to the entered value to get different EMI results for various situations. This can enable the borrower to know the principal amount and the loan term to apply for. SBI Bank is known for the competitive rate of interest offered on home loans.

To calculate the instalment amount, you must know the rate of interest, loan tenure, and loan amount. SBI EMI calculator online page and ease your monthly installment payments. Just enter the value of the loan amount, interest rate and select the tenure from the dropdown. The equated monthly installments will be calculated within seconds. Urban Money is India’s one of the unbiased loan advisor for best deals in loans and unmatched advisory services.

Account

Easy Calculation - The mathematical formula of the Home Loan EMI Calculator is complex. The use of the SBI Bank home loan EMI calculator makes this calculation easy. All one needs is the information of the principal loan amount, rate of interest, and loan tenure.

SBI is one of the reputed banks in India with more than 50 Crore customers in more than 25,000 branches. Whether it is deposits or loans, SBI ranks among the top in the list of banks and financial institutions in this country. SBI home loan EMI calculator, borrowers can calculate their monthly installments before applying. Amortisation Schedule - The SBI home loan EMI calculator provides the useful bifurcation of the principal amount and the interest component of the home loan. The amortisation schedule proves especially helpful during loan repayments.

Credit Card

The borrower can opt for a longer tenure to diminish the impact of expensive EMIs. Many individuals prefer to pay EMIs over a more extended period than doesn’t dent their monthly budget. By clicking "Proceed" button, you will be redirected to the resources located on servers maintained and operated by third parties.

Privilege Home Loans is an exclusive home loan product for government employees whereas Shaurya Home Loan is for Defense Personals. SBI Flexipay Home loan provides an eligibility for a greater loan. It offers customer the flexibility to pay only interest during initial 3-5 years and thereafter in flexible EMIs.

SBI bank EMI calculator, users will get pictorial representations, which prove to be advantageous. Irrespective of place and time one can access this calculator and take charge of their financial decisions on the go. This section will help you know about some benefits of using an EMI calculator. SBI charges anywhere between 0.3% to 1% of the total loan amount as their fees. Let’s glance over the Loan Amortisation Schedule on a home loan of Rs 10,00,000 at a 7.05% interest rate to be paid in ten years.

The home loan EMI calculator SBI on our website is available free-of-cost. You can use it to know the total interest payable and the total payment up to the loan’s tenure, along with instalment to be paid every month. The SBI home loan calculator will help you calculate the total monthly EMI and interest amount you would have to bear even before applying for the loan. The calculator helps you to plan your repayment process in advance. It clarifies to the borrower to assess and determines monthly EMIs they’ll bear against the loan.

The subsidy is available to individuals earning up to Rs.18 lakh per year. You can avail pre-approved loans from SBI through their YONO App. It is to be noted that only pre-selected applicants who check off certain parameters are eligible to avail of this option. Suppose you take a home loan of INR 50,00,000 at an annual Interest rate of 9%.

Not entering the processing fee will not affect your results, but the other three inputs are mandatory to get precise results. Thus, EMI will be re-calculated using the outstanding loan principal. However, some lenders do not re-calculate the EMI but reduce the loan term.

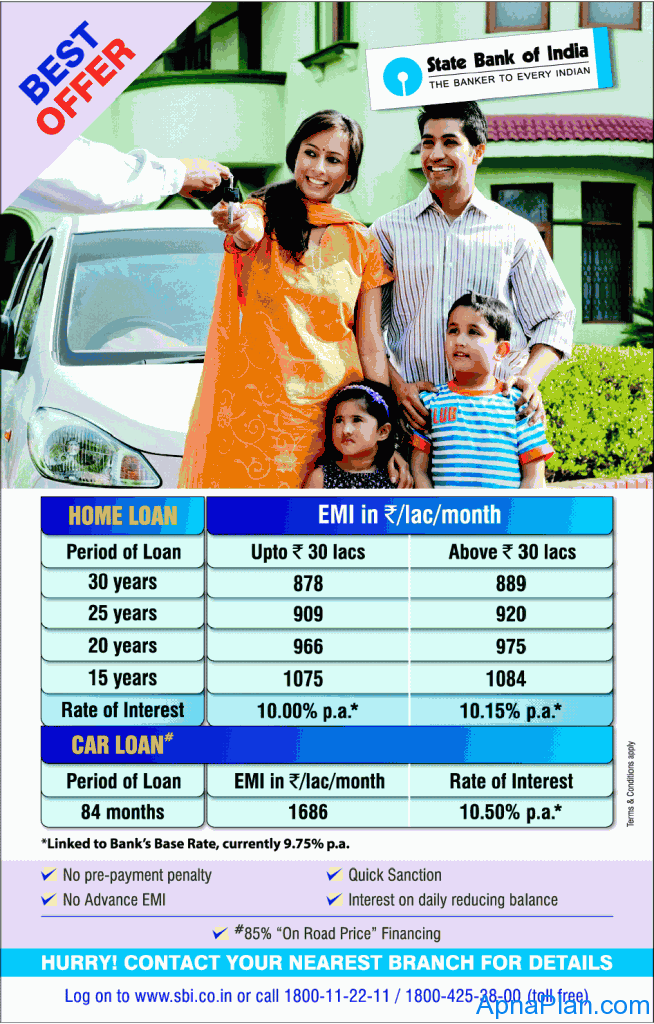

Note your monthly expenses, liabilities, and other financial obligations, including ongoing EMIs. Here we have illustrated the EMI on SBI home loan of Rs. 1 lakh @8.75% across different tenures. Below given is the housing loan information by State Bank of India.

Simply enter the loan amount, interest rate and loan tenure, and it’ll give you an estimation of the monthly EMIs against your home loan. You can pay your SBI home loan EMI online by transferring the funds from your savings account to the loan account via NEFT. In ahome loan calculator, you need to mention the loan amount, the home loan interest rate and the tenure for which you want to take the loan. Based on these details, you get the table with the information about the EMI, the total interest outgo and the total amount (interest+principal) for each year till the last year of the loan.

Home loans are financial assistance offered by the banks that can be availed by an individual who wishes to acquire real estate. The property acquired is offered as collateral to the bank and is repaid through monthly EMIs. SBI, the largest multinational bank in India, sanctioned many home loans under this scheme.

No comments:

Post a Comment