Table of Content

The SBI Home Loan EMI Calculator tells you about the EMI value. It is dependent upon loan principal, loan term, and the rate of interest. Whereas the SBI Home Loan Eligibility Calculator tells you about the maximum amount of home loan the borrower is eligible for. It is dependent upon the income, job profile, age, and credit score of the applicant. Cost of Loan – In addition to the EMI value, SBI home loan interest rate 2022 EMI calculator also apprises the user of the total interest outflow on the home loan amount. As longer loan tenures have higher interest implications, the borrower can reduce the loan tenure or principal amount to reduce the loan cost.

Usually, the lenders accept about 50% of your monthly income to be consumed by EMIs or other fixed obligations. If such obligations exceed further, the bank may either reduce the loan amount or may increase the loan tenure. You may also pay back some of the existing short-term loans so that the FOIR gets improved.

State Bank Of India's Ifsc Codes

On submission of the above parameters, the SBI Bank Home Loan EMI Calculator will calculate the EMI value corresponding to the inputs. The EMI value, along with the break-up of the total amount in terms of interest and principal, will be shown graphically and in a tabular form. The above illustration reflects the EMI over tenure of 5 years, 10 years, 15 years, and 30 years. It is evident that on a longer tenure, the interest payout is more against that on a shorter tenure. You should choose tenure that you are comfortable with, keeping in mind the total payout every month.

The SBI Home loan calculator gives you an accurate brief on monthly EMI payments. SBI offers "SBI Home Top Up Loan" to their customer to borrow certain amount over and above their home loan amount. The customer who already have a home loan from SBI and requires more funding, can opt for Home Top up loans. The interest rates are much lower than usual personal loan interest rates. In this method, the lender considers the ratio of your fixed income to obligations. It ascertains the maximum EMI you can spend, with regard to your net monthly income and expenses .

Calculate SBI Home Loan EMI

No processing fee will also be levied by SBI on top-up and regular home loans. Individuals must have a good CIBIL score to avail the offer. Just like other loans, home loans are also given based on the repayment capacity of the applicant. Since it is also a debt, SBI takes into account the salary or income of the applicant before deciding the loan amount. There is also a facility to calculate the eligibility for a home or housing loan.

Note your monthly expenses, liabilities, and other financial obligations, including ongoing EMIs. Here we have illustrated the EMI on SBI home loan of Rs. 1 lakh @8.75% across different tenures. Below given is the housing loan information by State Bank of India.

SBI Home Loan EMI Calculator Formula

SBI Surakhsha State Bank of India's SBI Suraksha is a life insurance policy linked to the bank's home loan. The premium of this life insurance policy is paid by the bank. The repayment duration is the same as the tenure of the home loan as Equated Monthly Instalments . This is available to new home loan customers and also to existing home loan customers who have chosen the SBI Life Cover. The SBI Home Loan Amortisation schedule gives a monthly breakdown of the repayment process.

Under the Credit Linked Subsidy Scheme of this Yojana, first-time and eligible borrowers can avail subsidies on their home loan interest rate. SBI Home Loan EMI calculator results depend upon the values of loan principal, loan term, and rate of interest offered by SBI Bank on home loans. In order to get a home loan, the bank will first assess your financials in order to confirm whether you are able to pay the EMI on time. By entering the values of the three parameters in the SBI Bank home loan EMI formula, the borrower can gauge the corresponding EMI value.

Home Loan Customer Care

This is the simplest method to calculate the Home loan eligibility. In this method, the lender applies a multiplier to your net take home salary. This multiplier is actually a function of your company profile and the take-home salary. If you earn a good salary and work in a company with a good reputation, this multiplier will be high enough and it will impact your home loan eligibility in a positive way. It will also mean that you will be able to get the best home loan rates too. But, this is the most ideal rate which is mostly offered to govt officials or individuals who are in top companies.

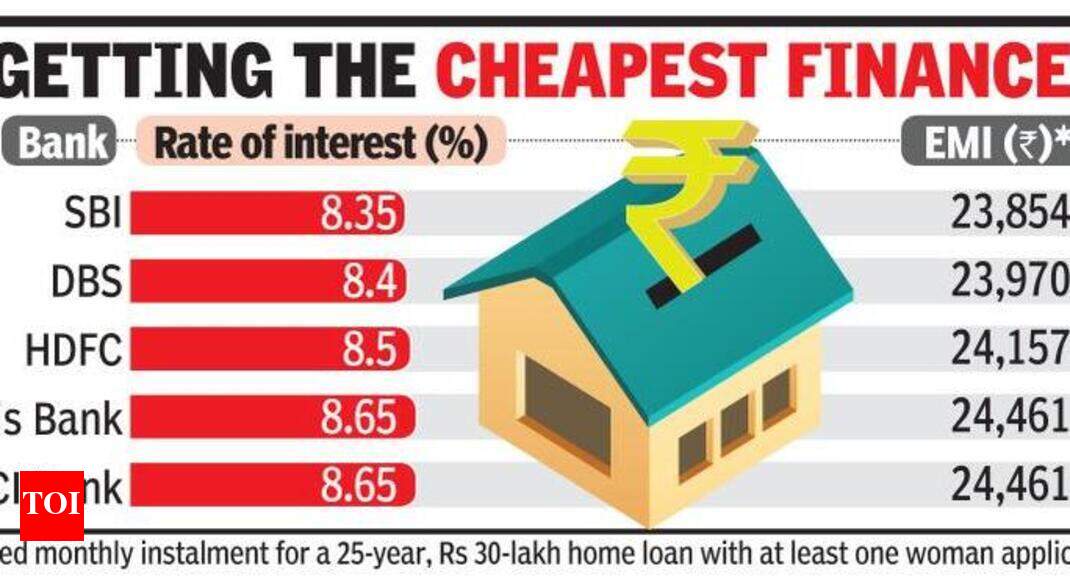

Borrowers with a credit score of 750 to 799 will have to pay a 7.65% interest rate with a risk premium of 10 basis points. SBI has increased the marginal cost of fund-based lending rates by up to 0.10% effective from 15 July 2022. Before taking a home loan from SBI, it’d be a good idea to check whether you will be able to pay the monthly instalments. The easiest way to do this is to use Home Loan Calculator. Just enter the proposed loan amount, the tenure of the loan, the interest rate the bank is offering you, and the processing fee.

SBI doesnt take any responsibility for the images, pictures, plan, layout, size, cost, materials shown in the site. We have a network of + branches, sales teams and processing centers across the country to cater to the housing loan requirements of individual customers. Please locate us and contact us for your home loan requirements.

In fact, long hours of manual calculations can prove both inaccurate and time-consuming. SBI loan EMI calculator enables borrowers to remove all confusion while focusing on how much to pay and at what time. Yes, SBI does give pre-approved home loans for which you can contact the bank for more details. SBI interest rates are pegged to floating interest card rate which currently stands lowest at 8.55% p.a. You can repay your EMIs online with the help of Net banking.

Although you are required to have an online SBI account to avail of this option. You’ll also find a table below that’ll give you a brief on how the repayment process will work against your loan balance. SBI easy home loan EMI calculator, by simply entering the loan amount, interest rate and select the loan tenure from drop down.

Interest rate concession of 25 basis points would be provided to borrowers with more than 75 Lakhs home loans. It is to be noted that the interest rate concessions are directly linked to the applicants' credit scores. The loan tenure plays a significant role in determining the monthly EMIs.

Government Schemes

With a click of the mouse, borrowers can quickly check the total number of repayments to be paid. With the rising standards of living, we all need assistance to meet increasing capital demand. In case you are out of money, applying for a loan is the most viable medium of financial survival. A lot of financial institutions can help you in this regard.

Shows the results based on the fractional rate of interest.

No comments:

Post a Comment